Infopunk Issue #5 – Brain Bonds: Bridging Curiosity, Creativity, Investing, and Character Patterns

Curiosity, Creativity & Conceptual Ancestors, Capital Returns & The Neuroscience of Personality

A startup I admire - Sindarin.tech - Click if you want your mind blown. It is clear for me that this is the future of pitch decks, amongst many other business and consumer applications.

A song I like – Rock Triste

On Curiosity, Creativity & Conceptual Ancestors

This episode of Infinite Loops features Billy Oppenheimer, a researcher for prominent psychologist Ryan Holiday. He joins the show to discuss the topics of curiosity, creativity, and what Billy calls “Conceptual Ancestors”…

Here are some highlights that resonated with me and might pique your interest:

Curiosity is the shit-starter.

Curiosity is the cure for boredom, there is no cure for curiosity.

Nothing begins with us, we are a vessel for the experiences and ideas we come across.

All of my output is a function of what I’m reading and experiencing.

Nikola Tesla believed our brains were essentially recievers and broadcasters, and that literally you pull your best ideas from “the ether”.

You can learn to have better taste through repetition.

Curiosity is insubordination in its purest form .

Skill is the ability to do something, talent is the rate at which you acquire the ability to do something.

There are only like 2 or 3 human stories and they go on repeating themselves as fiercely as if they had never happened before.

All great stories are a version of each other, just with different characters.

Introjection - finding people you admire and letting them be your conceptual ancestors. Who do you admire? How can you emulate a version of that?

Do you think everything is a remix? I’m a big believer in that idea. Maybe distinctiveness emerges from your unique remix.

Could one script make one movie or could it make 500 movies? If you and I had the same exact script, we would make 2 different movies. And if you and I read the same book, the things we would pull out of it would be different. We are working with the same raw material but what you find interesting and what you wanna pull out and add to your remix, that’s were your unique perspective comes in and allows what we believe to be original work.

If you think something is original you just don’t know the sources. To be original is to have the most obscure sources.

Perfection is a 100% tax. It is unattainable. You are only fooling yourself if you think that you know. Searching for certainty is a fools’ errand, there is no such thing.

Crazy is just a numbers game. The more people believe it, the less crazy it is.

My aim in life is to unite my vocation and avocation as my two eyes make one in sight.

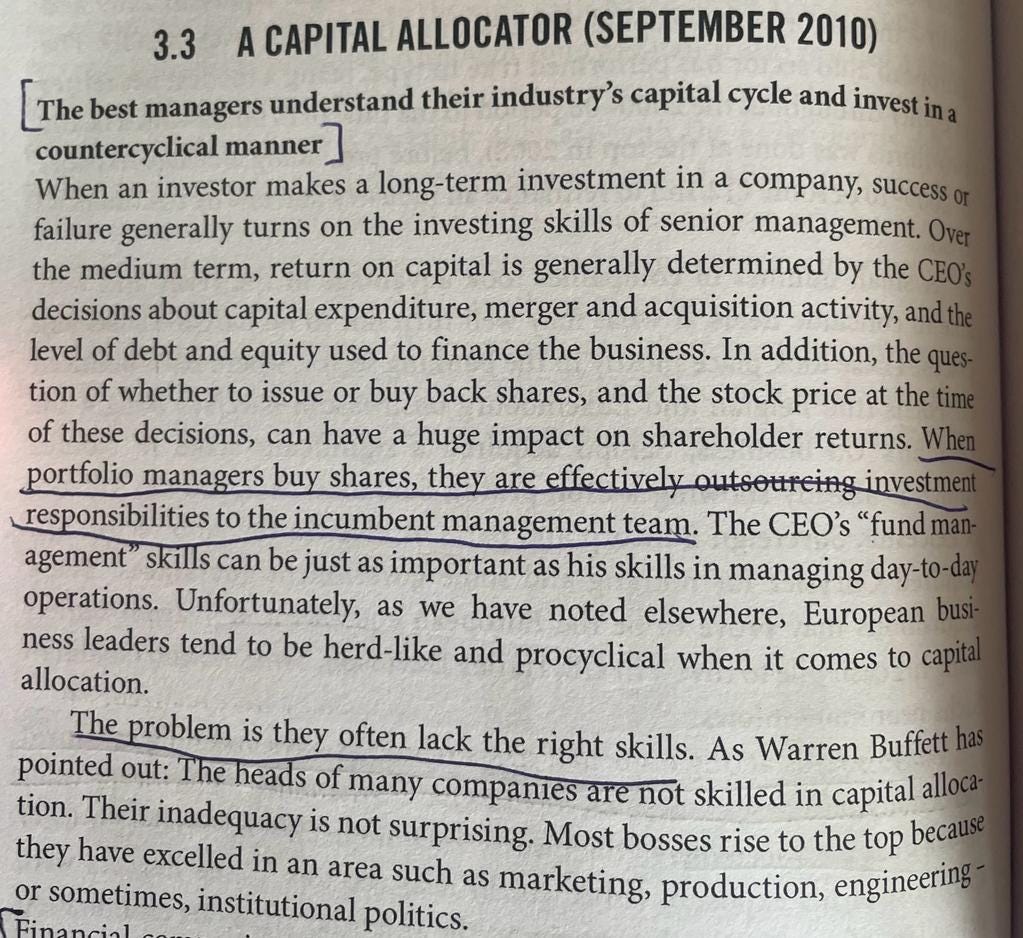

"Capital Returns: Investing Through the Capital Cycle" is a book edited by Edward Chancellor that was published in 2015. The book is a collection of essays and reports from Marathon Asset Management, an asset management firm with around $20 billion under management, that were published between 2002 and 2015.

The book outlines the capital cycle approach to investing, which is a framework for analyzing how the competitive position of a company is affected by changes in the industry's supply side. The book argues that the real returns come from paying attention to the supply side of the industry, rather than just focusing on the demand side.

Here are 3 highlights from the book + some photos of things that caught my eye:

Capital cycle analysis: The book introduces the concept of capital cycle analysis, which is a framework for analyzing how the competitive position of a company is affected by changes in the industry's supply side. The book argues that investors should pay attention to the supply side of the industry, as this is where the real returns come from.

Competitive advantage: The book emphasizes the importance of analyzing a company's competitive advantage and how it changes over time. The book argues that investors should focus on companies that have a sustainable competitive advantage, as these companies are more likely to generate long-term returns.

Long-term perspective: The book advocates for a long-term perspective when it comes to investing. The book argues that investors should focus on the long-term prospects of a company, rather than just short-term gains. The book also suggests that generalists make better capital cycle analysts, as they are more likely to adopt an outside view and do capital cycle comparisons between industries.

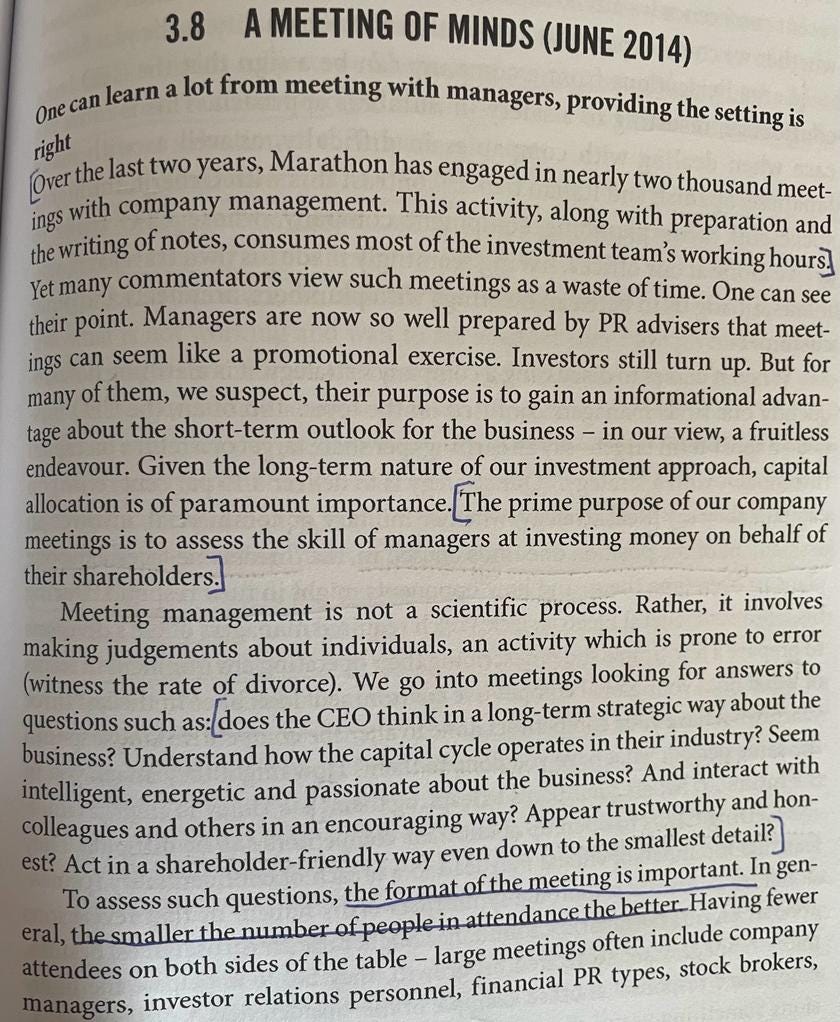

A Meeting of Minds

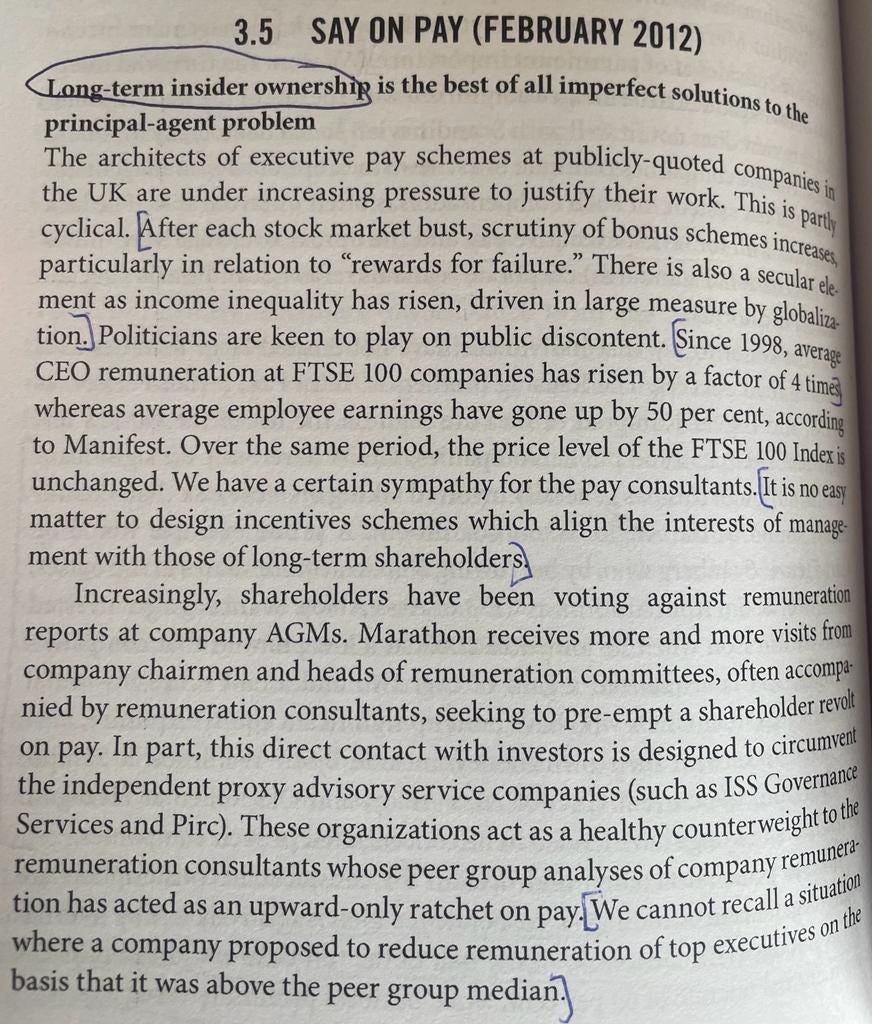

Say on Pay

A Capital Allocator

Unraveling the Intricacies of Personality

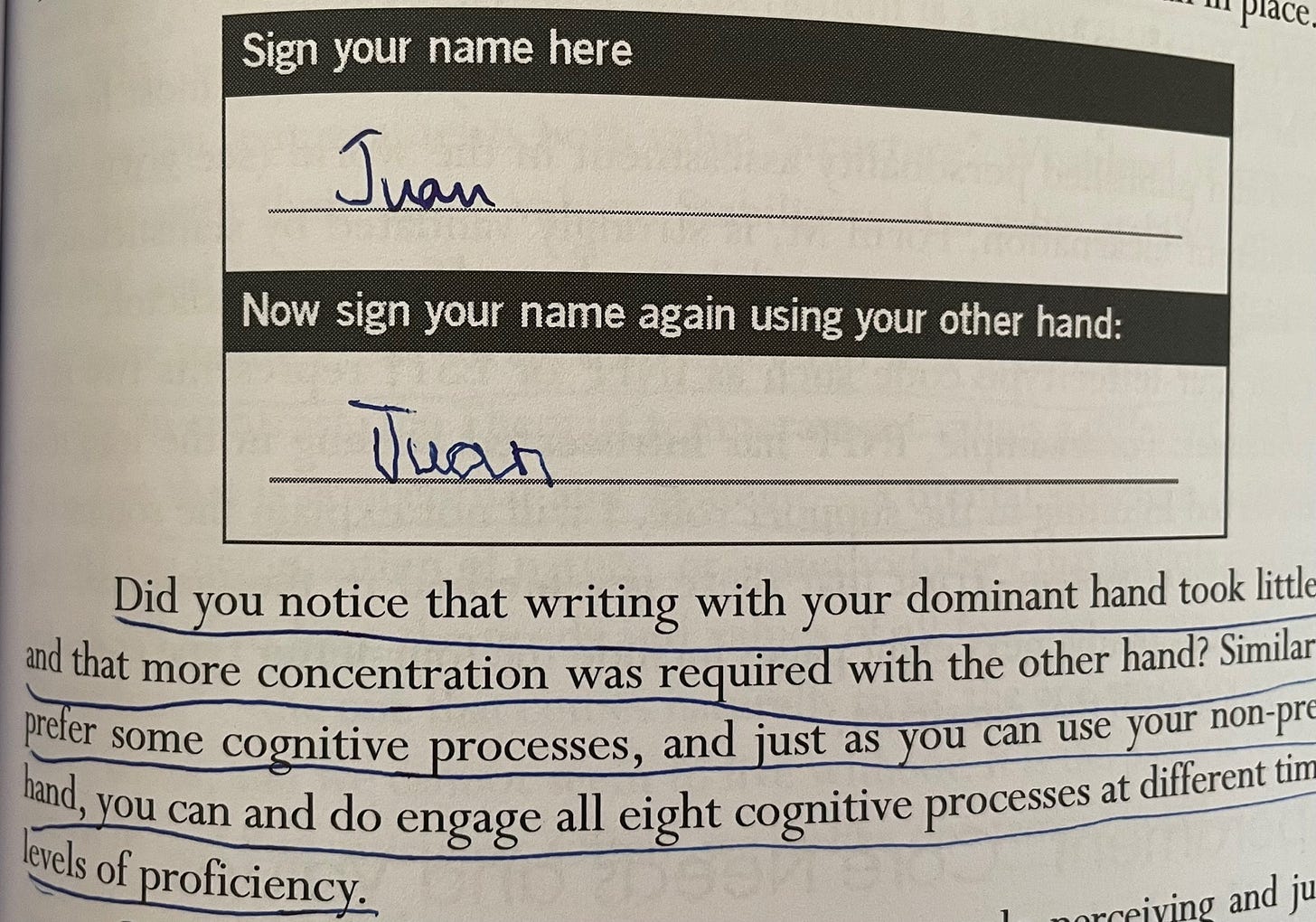

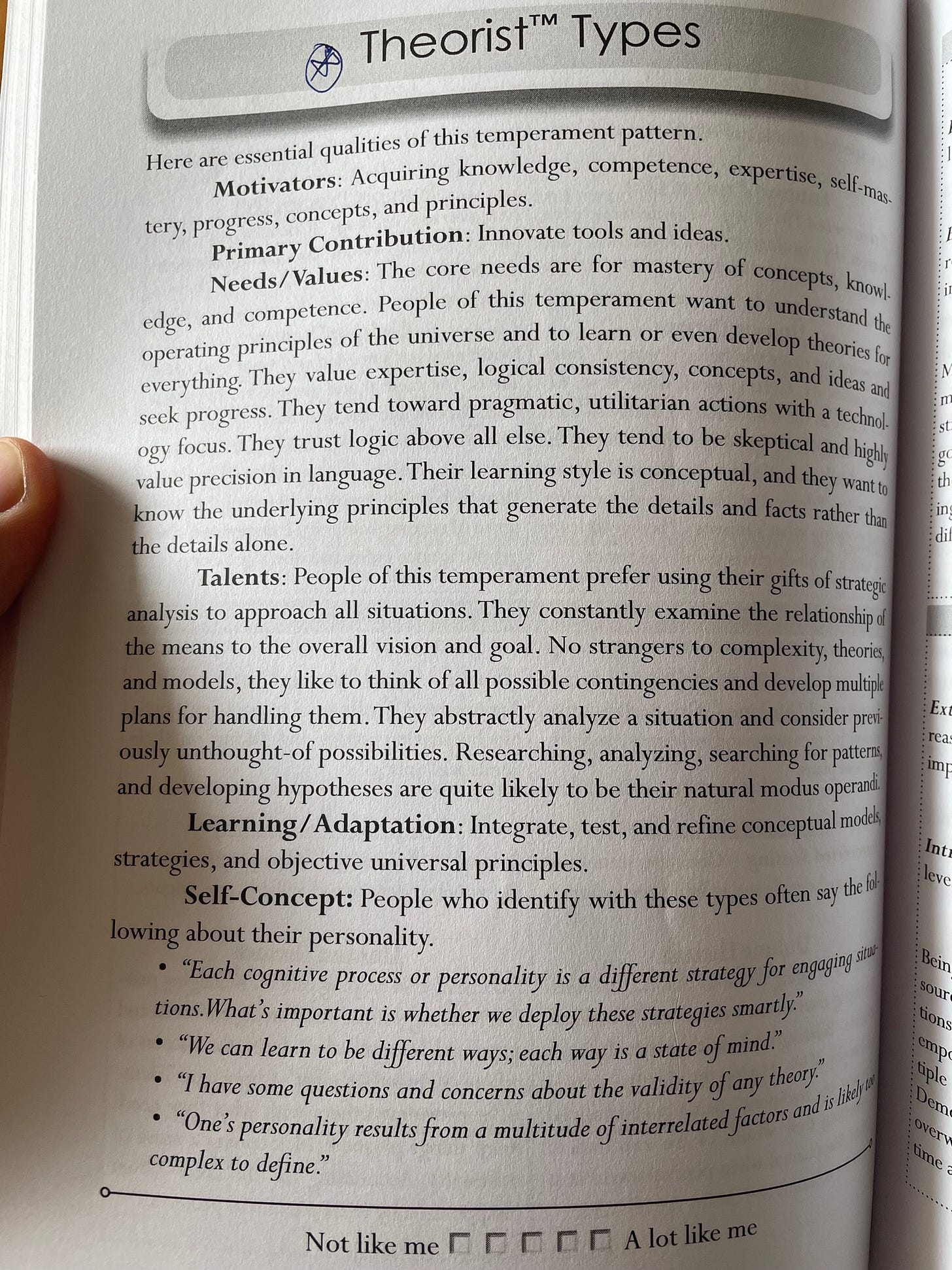

I've recently been reading Dario Nardi's thought-provoking book: The Neuroscience of Personality. Nardi has an interesting background, having been trained as an aerospace engineer with a PhD in Systems Science an Industrial Engineering. Throughout his career as an academic and entrepreneur, his interest was piqued by personality research and through pursuing his curiosity, he became a prominent neuroscientist that researched and taught both programming and Human Complex Systems at UCLA. In this book, he expertly weaves together cutting-edge research and neuroscience findings to shed light on the enigma of human personality. Below are five highlights that I hope will give you some light on whether you might enjoy the book:

Your Brain's Unique Signature: Did you know that your brain's wiring plays a fundamental role in shaping your personality traits? Nardi reveals how various patterns of brain activity, as captured by neuroimaging techniques, can provide valuable insights into understanding and predicting individual differences in personality. Discover the astonishing connections between neural patterns and traits such as extraversion, openness to experience, and conscientiousness.

Personality Mapping: Through Nardi's pioneering research, he introduces the concept of "brain types" – distinct patterns of brain activity that correlate with specific personality traits. Dive into the exciting realm of brain mapping and uncover how different brain regions communicate and contribute to our characteristic behaviors, preferences, and reactions. Explore the significance of brain type diversity and how it influences our interactions with others.

Emotional Intelligence and Brain Connectivity: Discover the relationship between emotional intelligence and the neural circuits within our brains. Nardi illuminates the crucial interplay between emotions, social cognition, and personality, revealing how certain brain networks influence our ability to understand and manage our own emotions and empathize with others. Learn practical insights for enhancing emotional intelligence and fostering meaningful connections.

The Influence of Neurotransmitters: Delving deeper into the neuroscience behind personality, Nardi explores the impact of neurotransmitters on our behavior and temperament. Uncover the intricate dance of dopamine, serotonin, and other chemical messengers within our brains, and their profound influence on personality traits such as reward sensitivity, risk-taking, and sociability. Gain a fresh perspective on how these neurotransmitters shape our daily experiences and decision-making processes.

Unlocking Personal Potential: Nardi concludes with a compelling exploration of how understanding our unique brain-personality connections can empower personal growth and development. He lays out practical strategies for leveraging your brain's strengths, optimizing your cognitive abilities, and cultivating a more harmonious life. Align your brain with your environment and harness it to unlock a brighter future.

If the above highlights piqued your interest, you will find that Nardi's insights will not only deepen your understanding of yourself but also foster a greater appreciation for the fascinating diversity of human personalities that shape our world. I recommend you get your hands on this book to dive deep into the wonders of neuroscience and personality.

See you on the next issue.

Stay curious,

Chief Infopunk